how much does nc tax your paycheck

Just enter the wages tax withholdings and other information required. Therefore your annual net compensation will be.

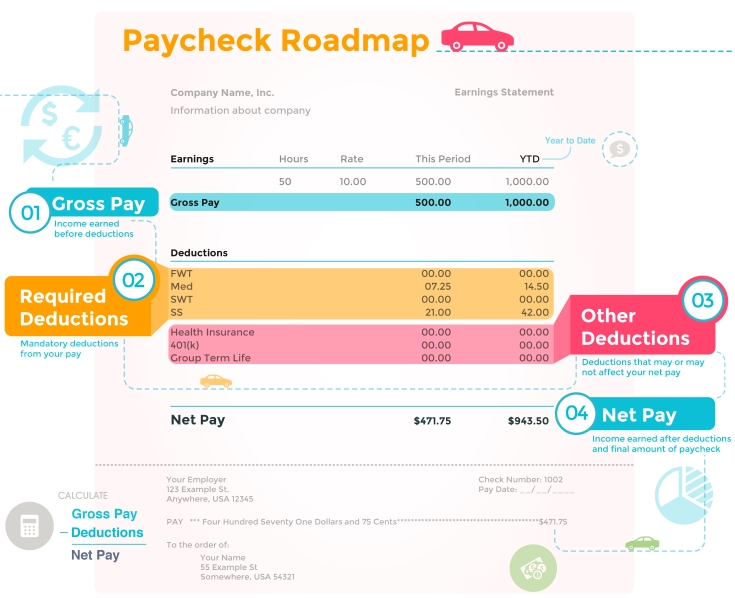

Where Does All Your Money Go Your Paycheck Explained

In Pennsylvania the flat tax rate in 2020 was.

:max_bytes(150000):strip_icc()/paystub-photo-56a634875f9b58b7d0e066f4.jpg)

. Our calculator has recently been updated to include both the latest Federal. The Different Types Of Taxes You Could Be Paying. All employers in the United States are required to match the FICA taxes for each of their employees.

14 hours agoIn terms of taxes 24 will be withheld for federal taxes 222984 million and in North Carolina about 525 is withheld for state taxes 48777750. Multiply the result by 100 to convert it to a percentage. So a business based in North Carolina has to pay 62 social security tax and.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions. The employer withholds this tax from the employees paycheck. Taxpayers may pay their tax by using a creditdebit card VisaMasterCard or bank draft via our online payment system or by contacting an agent.

Some states have a flat tax rate on incomes also known as the fair tax. North Carolina payroll taxes are as easy as a walk along the outer banks. Rates can be as low as 006 or as high as 576.

For tax year 2021. 17 rows North Carolina Paycheck Quick Facts. North Carolina payroll taxes are as easy as a walk along the outer banks.

North Carolina income tax rate. North Carolina levies state income tax at the flat rate of 525 regardless of income level and filing status. There is a flat income tax rate of 499 which means no matter who you are or how much you make.

Income Tax Deductions for North Carolina. The income tax is a flat rate of 499. That would leave you.

Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The North Carolina income tax has one tax bracket with a maximum marginal income tax of 525 as of 2022. Divide the total of your tax deductions by your total or gross pay.

How much is payroll tax in NC. For tax years 2015 and 2016 the north carolina individual income tax rate is 575 00575. Skip to main content.

North Carolina tax year starts from July 01 the year before to June. Annual Month Biweekly Weekly Day Hour Salary Summary If you make 50000 per year and live in North Carolina you will pay 9962 in taxes. 9 rows North Carolina moved to a flat income tax beginning with tax year 2014.

No state-level payroll tax. North Carolina Income Tax Rate. Detailed North Carolina state income tax rates and brackets are available on.

There is a flat income tax rate of 525 which means no matter who you are or how much you make this. You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. North Carolina has an individual income tax rate of 525 that applies to all income levels.

To pay this tax each quarter you will complete the Employers Quarterly Tax and Wage Report to report wage and tax information. Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income.

Hourly Paycheck Calculator Nevada State Bank

Confluence Mobile Unc Charlotte

2022 Federal State Payroll Tax Rates For Employers

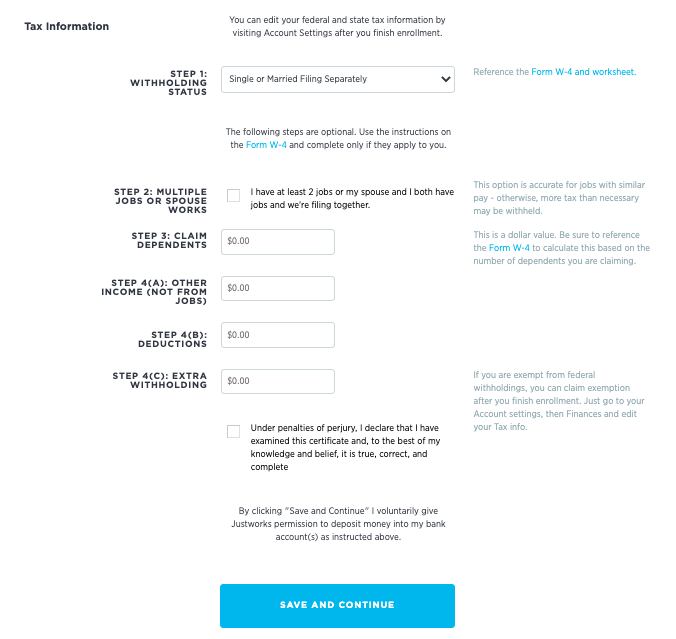

How To Calculate North Carolina Income Tax Withholdings

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

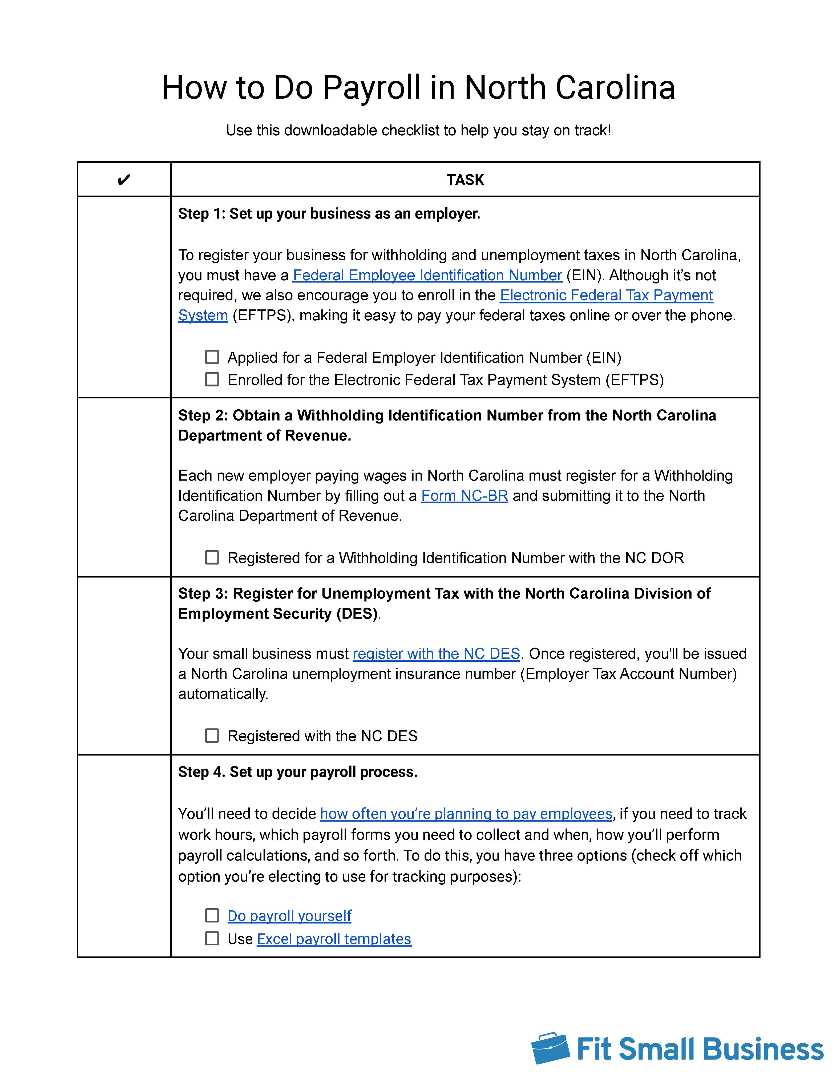

How To Do Payroll In North Carolina Detailed Guide For Employers

North Carolina Hourly Paycheck Calculator Gusto

With Tax Changes Time To Do A Paycheck Checkup Ncdhhs

Nc Says Good Bye To Earned Income Tax Credit Only State To Do So In 30 Years Wunc

State Individual Income Tax Rates And Brackets Tax Foundation

State Conformity To Cares Act American Rescue Plan Tax Foundation

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Complete Your Nc Withholding Allowance Form Nc 4 Youtube

How To Take Taxes Out Of Your Employees Paychecks With Pictures

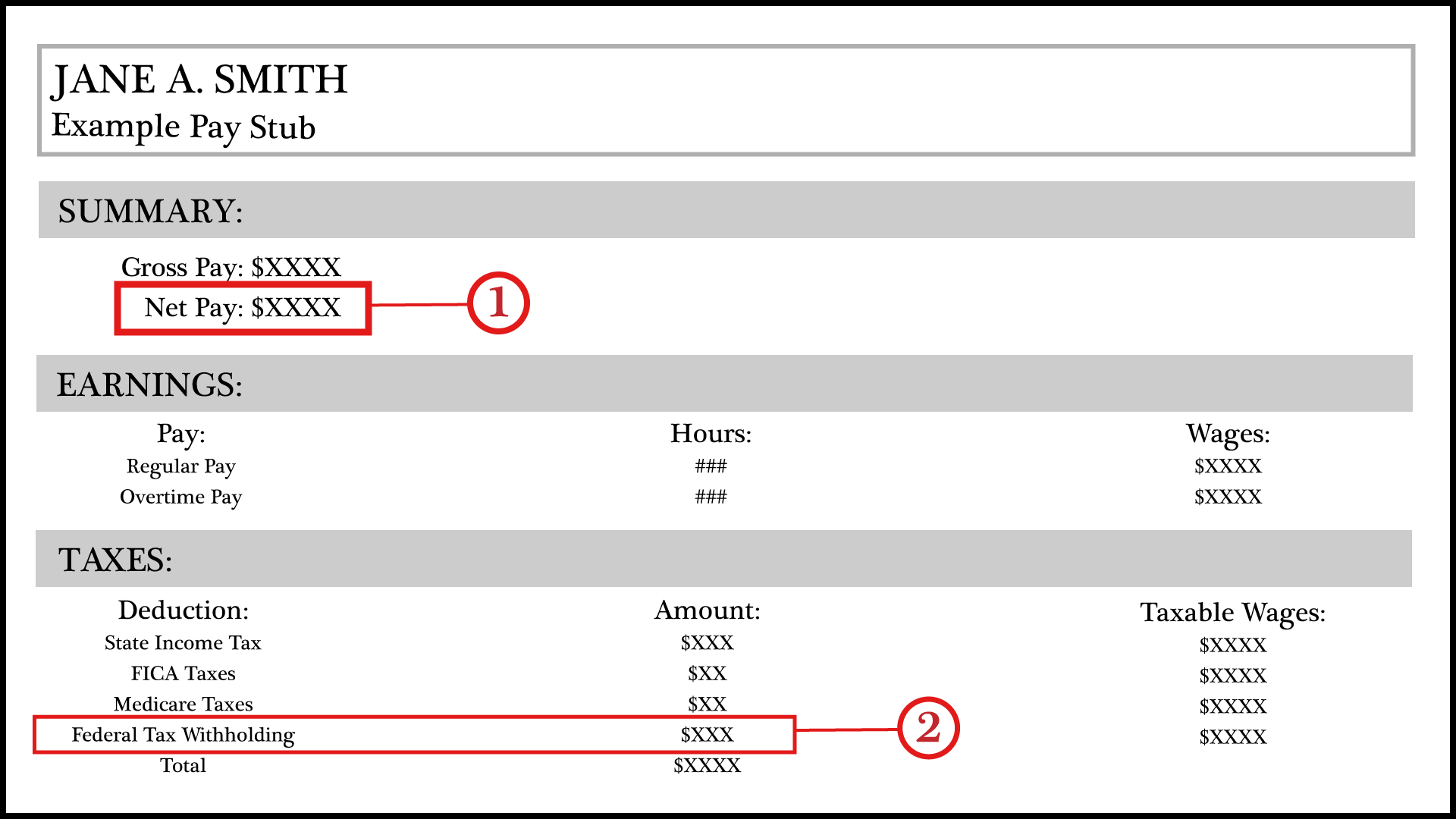

Questions About My Paycheck Justworks Help Center

Irs Announces Tax Inflation Adjustments Why Your Paycheck Could See A Bump Fox8 Wghp

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay